4-in-1 Card POC for IDFC FIRST Bank

How we provide an all-in-one experience for the users to pay and convert their payment easily with

only

a few swipes and clicks in the bank app

![]()

The proposal

SectorRetail Bank

Challenge

To increase the bank’s products usage and market share in India, we ran a design thinking sprint to explore user needs & pain points, and products visions, to create human-centered design products for the local market

My Role

Workshop Facilitation, Persona creation, Customer journey design

Workshop Facilitation

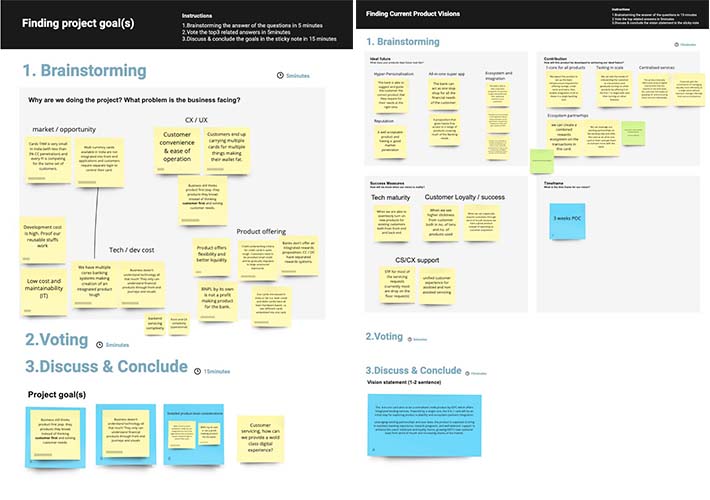

Workshop #1

In the 1.5 hours workshop, we focused on product goals and visions.

We align the focused topics with stakeholders and can act strategically despite limited time.

Collabration tool: Miro

Why are we doing this project?

By reviewing the existing project brief, we brainstormed additional problems that the business is facing in 5 minutes

- Market/ business opportunity

- CX/ UX opportunity

- Technical cost

- Product offerings

By brainstorming ideal future, contribution, success measure, and timeframe,

we voted and concluded a solid vision statement in 15 minutes

Workshop outcome

Aligned project goals and product visions

Workshop #2

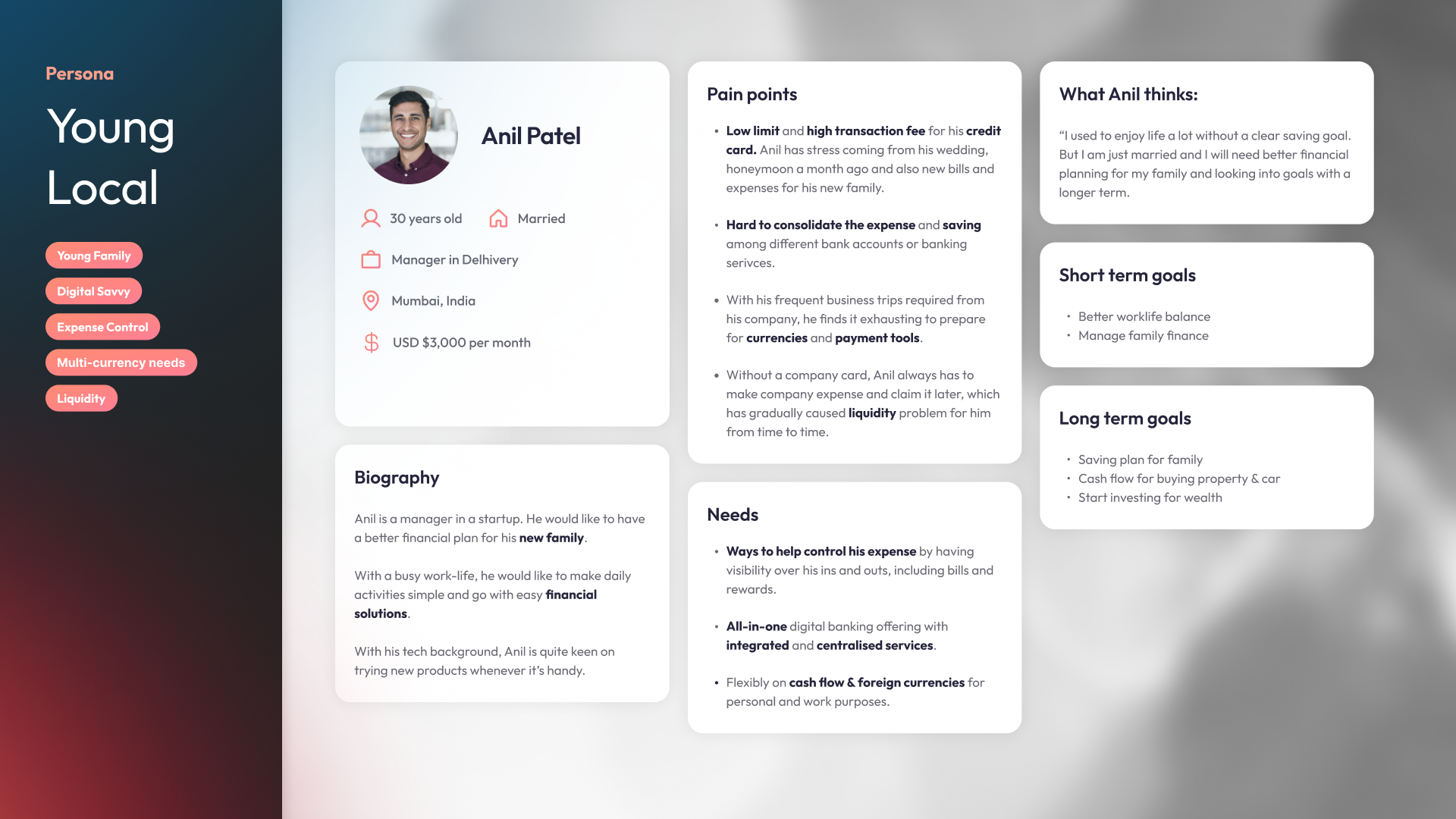

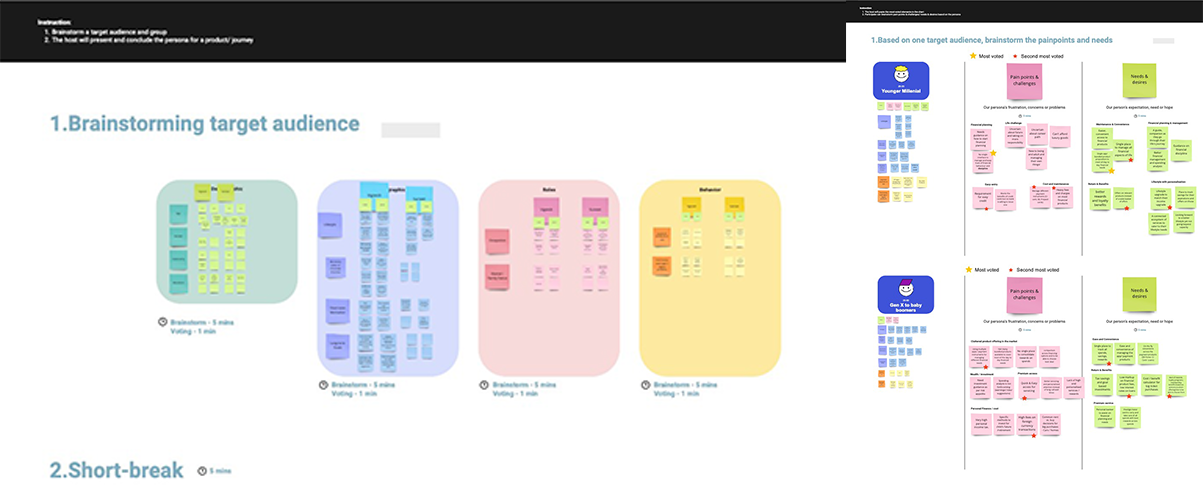

In the 1.5 hours workshop, we brainstormed target audience demographic, psychographics, roles, and behavior.

Based on the target audience profile, we brainstormed their pain points, challenges, needs, and desires.

Workshop outcome

Target audience profile, pain points & needs

Workshop #3

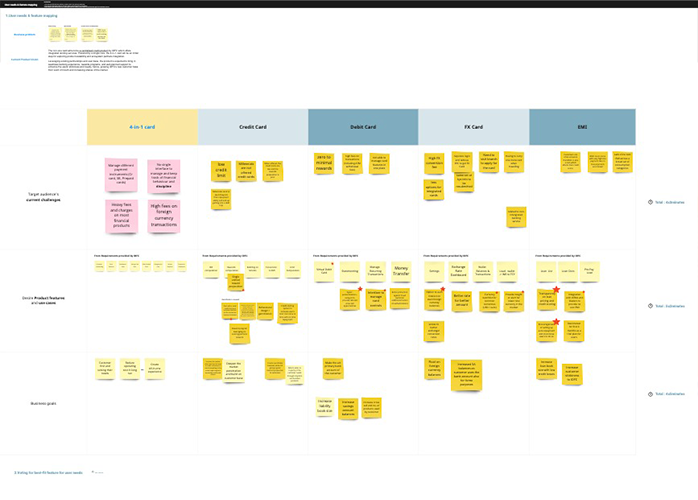

Based on the previous workshop outcome, we started mapping user needs and bank offering.

We targeted finding the best-fit features for users' needs

Workshop outcome

Prioritised Feature list based on user needs

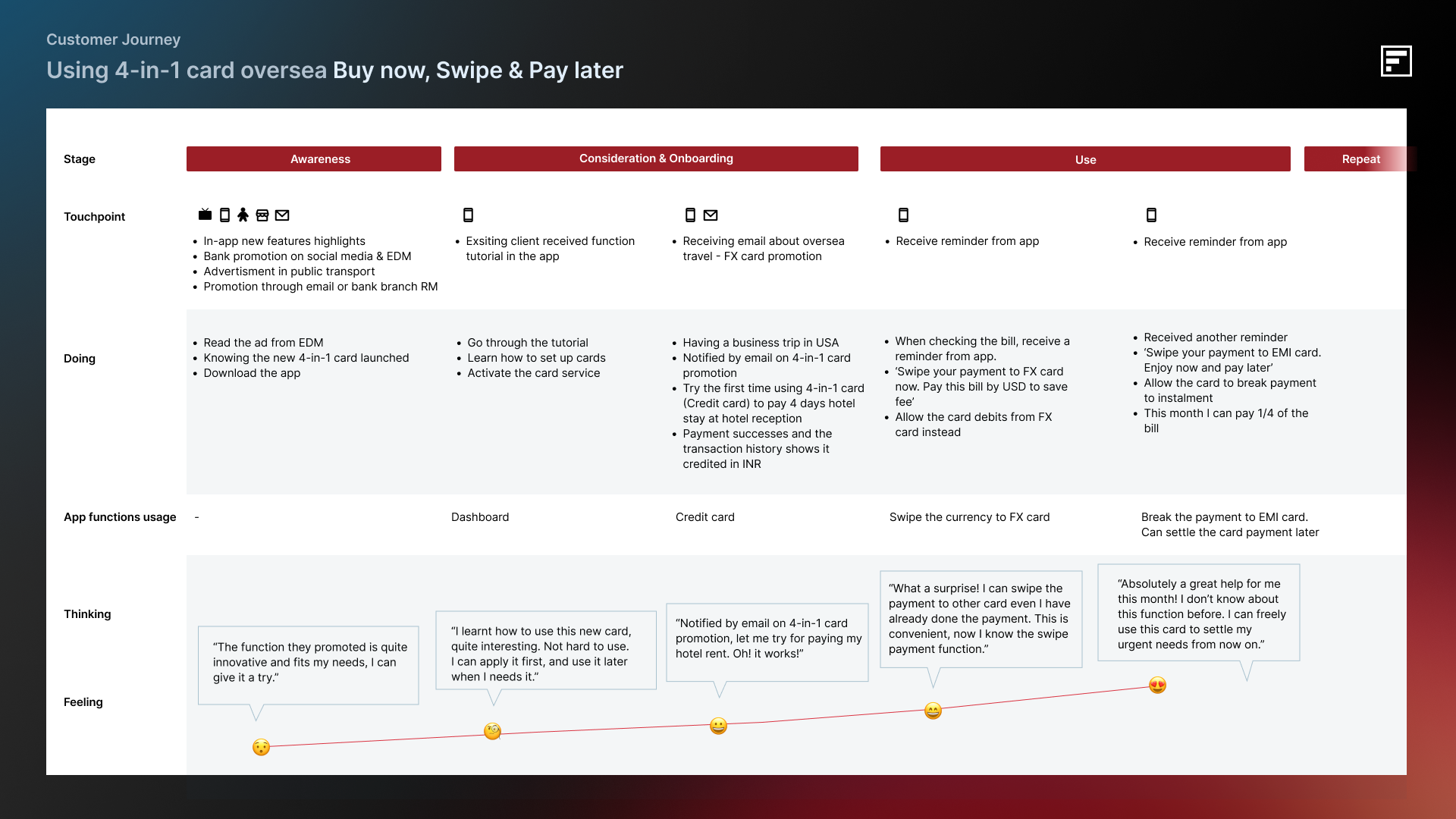

Persona & Customer Journey Creation

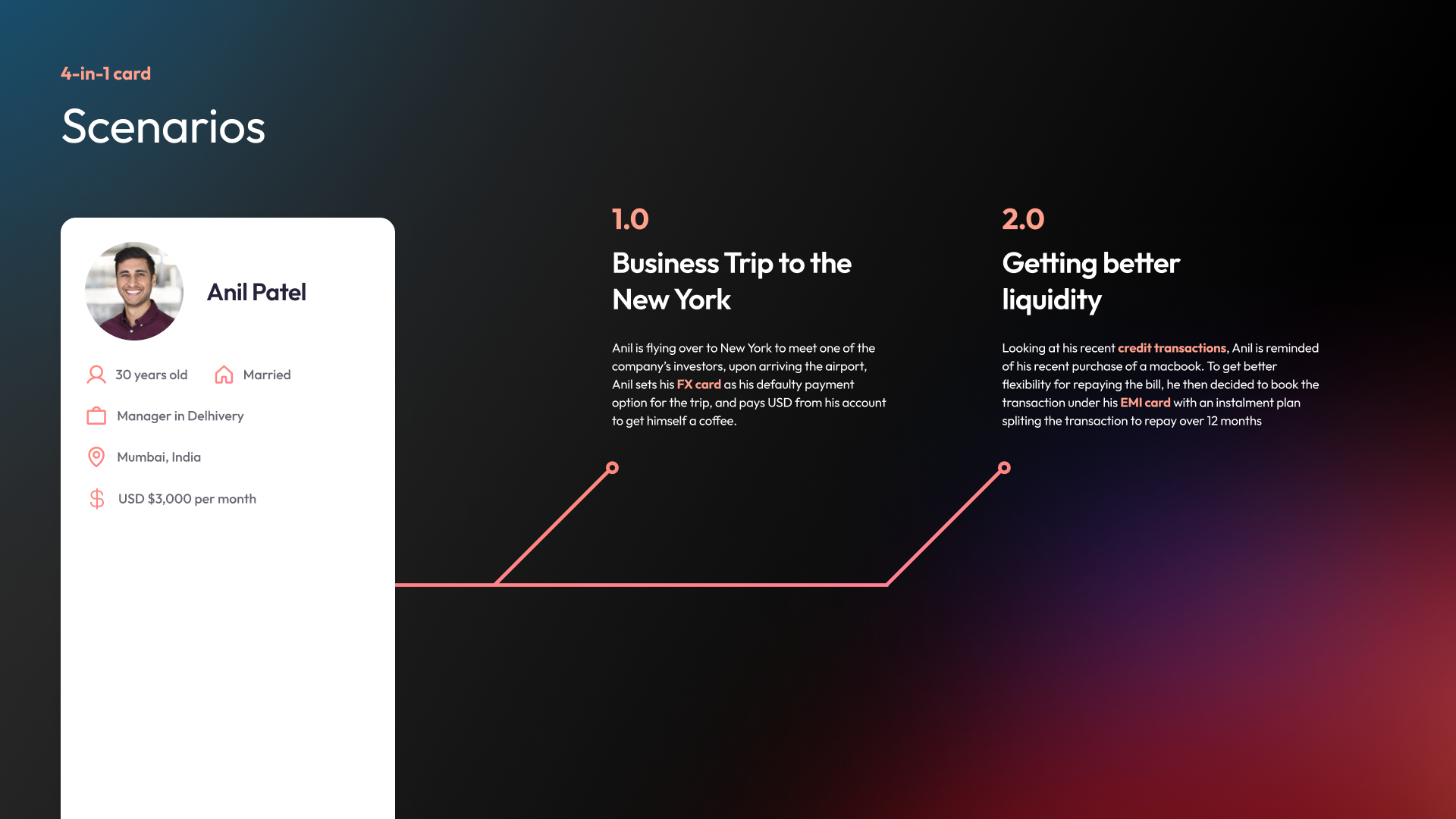

We went through 3 workshops, consolidated all insights, reviewed voted results. We successfully created an aligned user persona & customer journey for the new 4 in 1 card product.Understanding the pain points of the Indian market customers, features under the principle of centralized services as well as leveraging their ecosystem partners were designed and implemented in the demo.

The all-in-one card could be a powerful product only if it serves the right customer with the right needs. Workshops with stakeholders are then conducted to understand the target segments as well as the prioritizations of features that would ultimately bring the biggest impact to both the bank and their customers.

Based on the workshop findings and outcomes, user journeys along with a medium-res prototype are created to test and validate the concept. High fidelity designs were done and adapted with the client’s branding and most importantly, fully integrated and developed front-to-backend with Thought Machine.