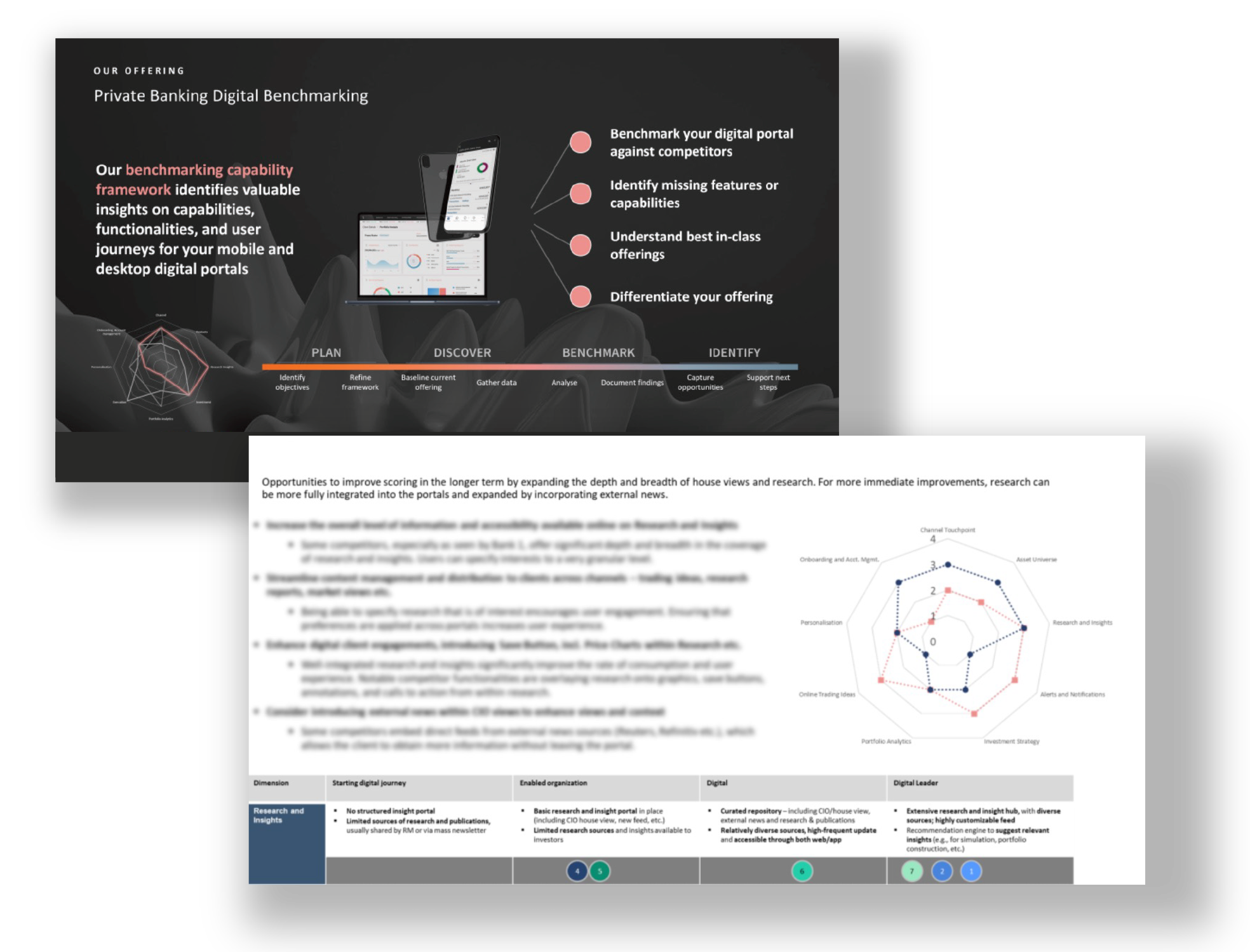

DBS Private Banking Digital Benchmarking

How we provide a scalable benchmarking framework and methodology to compare competitor capabilities, designs and processes

The proposal

SectorPrivate Bank

Challenge

The bank needs to benchmark its offering from a UX perspective to face the industry's digital transformation challenge, differentiate its products from the market, and create new business opportunities.

My Role

Workshop Facilitation, Heuristic Evaluations

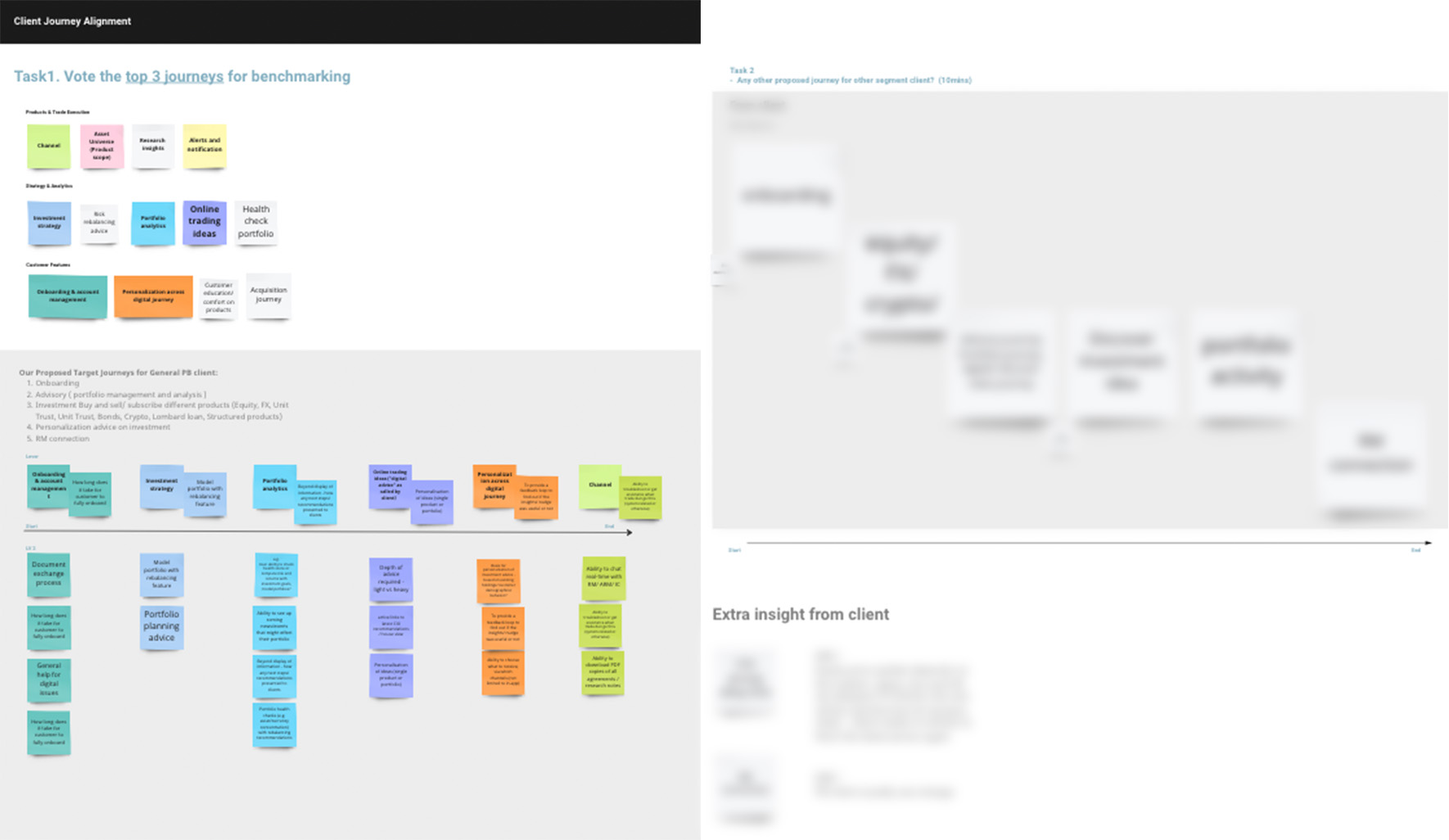

Workshop Facilitation

Workshop #1

In a two hours workshop, we decided top focus on the benchmarking framework from key dimensions in the private bank industry.

We made quick decision, to get commitment among stakeholders on focused topics and to be able to act strategically despite time.

Collabration tool: Miro

Benchmarking key dimensions

By reviewing the existing key dimensions, we brainstormed additional focused dimensions and priorities them in just 15 minutes.

- Risk rebalancing advice

- Health check portfolio

- Customer education/ comfort on products

- Acquisition journey

Essential insights/ highlights for each functions

To understand each lever’s insights, highlights, and functions, we ran 9 tasks to brainstorm in-depth ideas with stakeholders,

aligning focused areas to make sure the framework setting meets client expectation

Workshop outcome

Benchmarking framework in Primary Deep Dive Area/ Secondary Research Areas/ Tertiary Research

Workshop #2

In a one-hour workshop, we aligned the top 3 journeys for benchmarking UX journey.

We extracted extra insights from the existing client platform and put them in the benchmarking framework

Workshop outcome

Detailed customer journey screen flow for audition

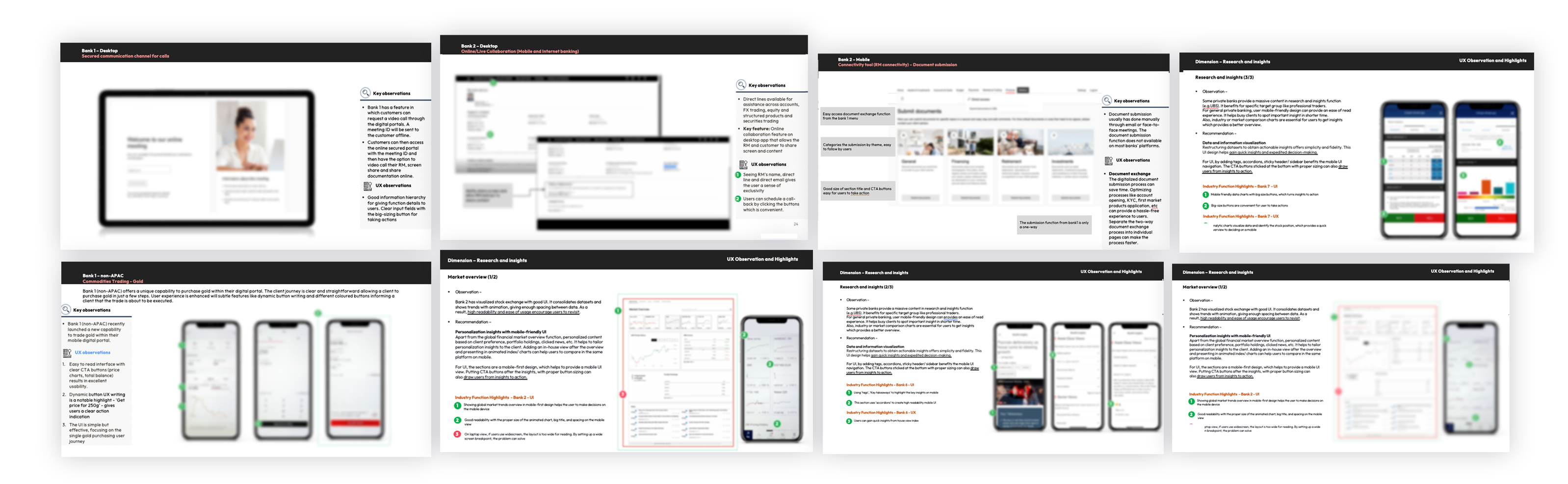

UX Audit: Conduct Heuristic Evaluation

We went through 7 private banks’ digital platforms and over 50 functions. We highlighted usability issues, unique functions, and offerings. We ranked the competitors' key dimensions with scores and provided recommendations to our client based on our findings.